An In-Depth Look at NBFCs: Functions, Types, and Differences

Access to credit remains a major hurdle for NBFCs, especially with the decline in bank credit. Recent data shows that bank credit to NBFCs dropped to 6.4%, down from 18.3% the previous year. This shift emphasises the growing need for NBFCs to explore alternative funding solutions.

NBFC regulations ensure financial stability, consumer protection, and transparent lending practices. Businesses seeking funds, whether through loan companies, asset finance firms, or fintech-led lending platforms, benefit from understanding the framework that guides NBFC operations. This clarity helps them choose trustworthy partners and mitigate financial risks.

Modern financial platforms like Recur Club also align with regulatory standards to ensure compliant, responsible, and transparent financing.

Before we dive in:

- NBFCs in India are regulated by the Reserve Bank of India (RBI).

- Regulations ensure financial stability, customer protection, and ethical lending practices.

- RBI policies govern capital requirements, governance, KYC, fair practices, provisioning, and risk management.

- NBFCs must register with the RBI and adhere to strict licensing criteria.

- Fintech platforms and NBFCs increasingly use technology for compliance, reporting, and real-time risk assessment.

- Understanding regulation helps SMEs choose safe, credible lending partners.

What Are NBFCs and Why Are They Important?

Non-Banking Financial Companies are financial institutions that offer lending, investment, and credit-related services without holding a banking license. They act as a bridge in India’s monetary system by serving market segments that banks may not reach efficiently.

NBFCs matter because they:

- Provide accessible financing to SMEs and startups

- Enable flexible lending structures suited to modern businesses

- Support consumer credit, infrastructure projects, wealth management, and more

- Drive financial inclusion in both urban and rural markets

While they cannot issue cheques or accept demand deposits like banks, NBFCs compensate with agility, innovative lending models, and faster underwriting. This makes them valuable funding partners for India’s business ecosystem.

Also read: Decoding the Loan Components in Working Capital Finance

Who Are NBFCs Regulated By?

NBFCs in India are regulated by the Reserve Bank of India (RBI) under the provisions of the RBI Act, 1934. The RBI oversees NBFC operations to ensure:

- financial system stability

- consumer protection

- responsible lending standards

- reduced default and fraud risk

- transparent financial practices

RBI regulates NBFCs because they collectively manage large volumes of public funds. Strong oversight ensures that NBFCs maintain adequate liquidity, capital buffers, and fair business practices similar in principle to banks, though with different regulatory intensity.

This regulatory clarity builds trust among borrowers and increases confidence when selecting lending partners.

Types of NBFCs and Their Regulatory Classifications

NBFCs are divided into multiple categories depending on their primary business activity. Understanding these categories helps businesses know who they are dealing with.

Each type is regulated differently based on risk exposure, customer profile, and systemic importance.

Key RBI Regulations Governing NBFCs

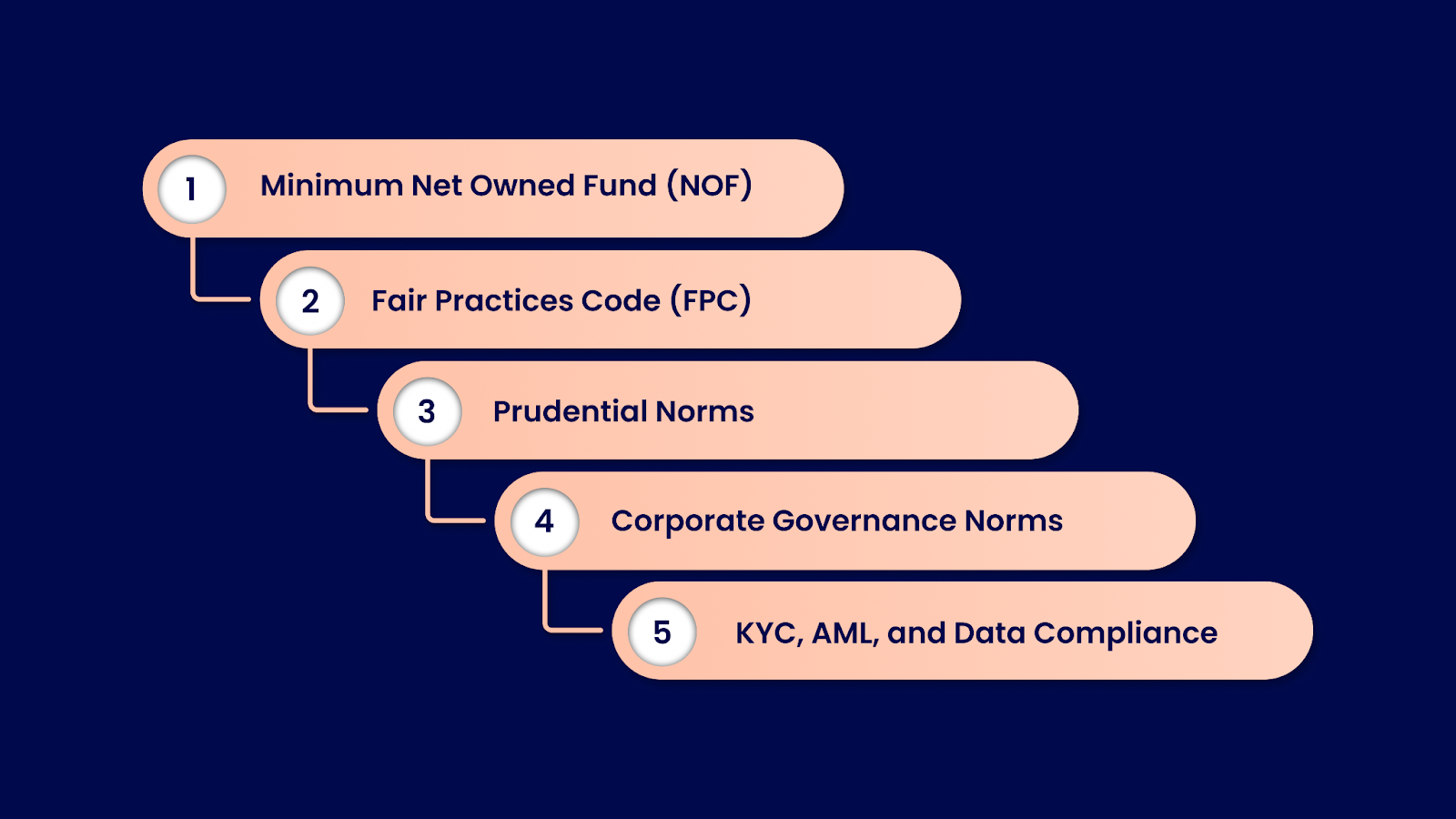

RBI imposes multiple regulatory requirements to ensure NBFCs remain stable and trustworthy. Some core areas include:

1. Minimum Net Owned Fund (NOF)

NBFCs must maintain a minimum level of capital to operate. This ensures they have a financial buffer to absorb losses.

2. Fair Practices Code (FPC)

NBFCs must follow transparent, ethical lending practices by clearly disclosing terms, avoiding coercive recovery, and ensuring customer fairness.

3. Prudential Norms

These include:

- Capital adequacy requirements (CRAR)

- Provisioning norms

- Exposure limits

- Asset classification guidelines

These norms ensure NBFCs manage credit risk responsibly.

4. Corporate Governance Norms

NBFCs must maintain strong governance structures, including independent board members, risk policies, and internal audits.

5. KYC, AML, and Data Compliance

Strict adherence to identity verification, anti-money laundering norms, and secure data handling is mandatory.

Platforms like AICA help improve data accuracy and streamline financial reporting, which is essential for meeting compliance and supervisory expectations.

Also read: What is the LOC Full Form in Banking and Why It Matters

How NBFC Licensing Works?

To operate legally, every NBFC must obtain an RBI Certificate of Registration (CoR) and satisfy several conditions:

- Minimum capital (NOF)

- Fit and proper management

- Clear business plan

- Strong governance frameworks

- Adequate IT and risk systems

- Transparent financial reporting

RBI grants licenses only to companies that demonstrate financial strength and responsible business conduct.

How are NBFCs monitored and supervised?

Regulation doesn’t end with registration NBFCs must undergo continuous monitoring through:

1. On-site inspections

RBI audits NBFC records, lending practices, and financial books.

2. Off-site surveillance

NBFCs regularly submit financial reports, including:

- NPA levels

- capital ratios

- fraud reports

- compliance filings

3. Supervisory frameworks

Large NBFCs are subject to tighter, bank-like supervision due to their potential systemic impact.

Technology has strengthened these processes by enabling real-time reporting and analytics.

Why NBFC Regulation Matters for Borrowers and Businesses?

Regulation protects borrowers just as much as it regulates lenders. For SMEs and startups, choosing a regulated NBFC means:

- Transparent terms with no hidden charges

- Protection from unethical lending practices

- Partnering with financially stable institutions

- Fair treatment during the lending lifecycle

- Better reliability during long-term financing

Recur Club’s compliance-led approach ensures businesses receive financing that is not only fast but also governed by responsible and ethical standards.

NBFCs vs Banks – Regulatory Differences

Here is a simple comparison to understand how NBFC regulations differ from bank regulations:

NBFCs offer greater flexibility and faster processes, making them attractive for SMEs seeking customised financing.

Also read: Apply for Unsecured Small Business Loans Online

How Regulations Shape NBFC Lending to SMEs?

RBI’s regulatory expectations influence how NBFCs lend to businesses:

- Rigorous underwriting processes

- Transparent pricing

- Limits on exposure to single clients

- Classification and provisioning norms

- Focus on financial discipline and creditworthiness

This ensures that SMEs receive fair, responsible credit. For platforms like Recur Club, aligning with regulatory expectations reinforces trust and enhances lending reliability for growing businesses.

Conclusion

Understanding how NBFCs operate, the rules they follow, and the protections they offer helps founders and finance teams make informed decisions about borrowing and long-term financial planning.

For businesses seeking access to capital through a trusted, compliant, and transparent platform, Recur Club combines regulatory alignment with advanced, data-driven underwriting to help you unlock growth with confidence.

Explore more competent, compliant, and flexible financing with Recur Club and accelerate your business growth today.

Frequently Asked Questions

1. Are all NBFCs allowed to accept deposits?

No. Only deposit-taking NBFCs authorized by the RBI can accept public deposits.

2. How can businesses verify if an NBFC is RBI-registered?

You can check the official RBI list of registered NBFCs available on the RBI website.

3. Are fintech lending platforms considered NBFCs?

Not always. Some partner with NBFCs to issue loans, while others may be licensed NBFCs themselves.

4. What happens if an NBFC violates regulations?

RBI may impose penalties, restrict operations, or cancel the NBFC’s registration.

5. Do NBFCs follow the same recovery practices as banks?

NBFCs must comply with the Fair Practices Code to ensure ethical and transparent recovery processes.

.png)